Unlocking the Power of Business Credit Builder

Building a strong financial foundation is key for any business looking to scale and grow. One essential tool in achieving this is a Business Credit Builder program. By establishing and maintaining business credit builder accounts, companies can access a range of benefits that can help them navigate financial challenges and seize new opportunities.

The Benefits of Business Credit Builder

Business credit builder services offer a host of advantages that can give your company a competitive edge. Here are some key benefits:

- 1. Improved Access to Funding: With a solid business credit profile, you can qualify for business credit builder loans with favorable terms and higher credit limits.

- 2. Enhanced Credibility: A BUSINESS CREDIT BUILDER card can help boost your company’s credibility with suppliers, vendors, and lenders.

- 3. Separation of Personal and Business Finances: Using business credit builder tradelines helps keep your personal and business finances separate, simplifying accounting and financial management.

- 4. Growth Opportunities: By establishing a strong business credit history, you can position your company for growth and expansion.

- 5. Risk Mitigation: Diversifying credit sources through business credit builder companies can help reduce your company’s overall financial risk.

A Closer Look at Business Credit Builder

Business credit builder programs are designed to help companies establish and strengthen their business credit profiles. These programs typically offer a range of services, including:

- – Business credit monitoring

- – Assistance with building business credit

- – Access to BUSINESS CREDIT BUILDER loans and other financing options

By working with business credit building services, businesses can proactively manage their credit profiles and take steps to improve their overall financial health.

Frequently Asked Questions

1. How long does it take to build business credit with a Business Credit Builder program?

Building business credit is a gradual process that can take several months to years, depending on various factors such as your company’s financial history and credit utilization.

2. Can a business credit builder card help my company secure better financing options?

Yes, utilizing a business credit builder card responsibly can improve your company’s credit profile and increase your chances of accessing favorable financing terms.

3. Are there risks associated with using BUSINESS CREDIT BUILDER loans?

As with any form of credit, there are risks involved in taking out business credit builder loans. It’s crucial to carefully assess your company’s financial situation and borrowing needs before committing to any financing agreement.

4. How can business credit builder companies help me establish initial credit lines for my business?

Business credit builder companies specialize in working with businesses to establish and build their credit profiles. They can provide guidance on the best strategies to secure initial credit lines and improve your company’s creditworthiness.

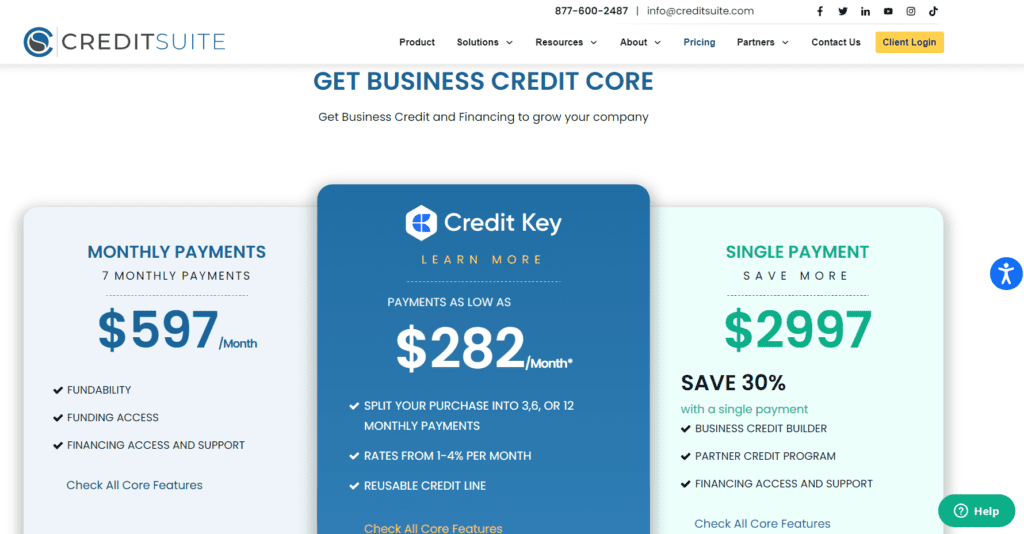

5. What are some of the most reputable business credit builders according to reviews?

When choosing a business credit builder, it’s essential to consider factors such as reputation, track record, and customer reviews. Some of the top-rated business credit builders include [Insert names based on research and reviews].

In Conclusion

BUSINESS CREDIT BUILDER programs offer a strategic approach to managing your company’s credit profile and unlocking new financial opportunities. By leveraging these services, you can strengthen your business’s financial foundation, enhance credibility, and position your company for long-term success.

Remember, building business credit is a journey that requires patience, diligence, and strategic planning. With the right tools and resources at your disposal, you can set your business on a path to financial stability and growth.